what is gst in malaysia

As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5. AMOUNT RM SUBTOTAL RM.

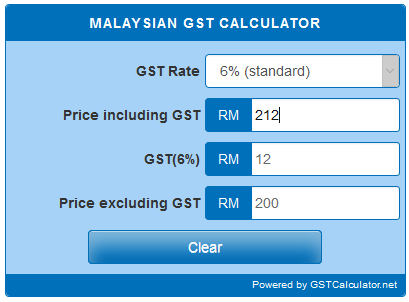

Malaysian Gst Calculator Gstcalculator Net

Moving between Inland Revenue sites.

. John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. The amount of late fees differs according to the type of return filing. Chow Chee Yen.

These documents contain the Rules of Bursa Malaysia Derivatives which have been updated as at the date above. GST Guide On Tax Invoice Debit Note Credit Note And Retention Payment After 1st September 2018. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

GST is an indirect tax expressed as a percentage currently 7 applied to the selling price of goods and services provided by GST registered business entities in Singapore. Not filing the GST return within the time period given by the department including the extension is considered as non-compliance with the law and attracts strict penalty amount. GST - Know about Goods and Services Tax in India with various types and benefits.

Late fees for non-annual GST returns. He said that while the GST was a more efficient tax system given that it promoted transparency and accountability the rate should also be limited to 2 to 3. To calculate GST value based on the salespurchase value.

This is universal free online GST Calculator for any country where Goods and Services tax GST is implemented. 株式会社大創産業 Kabushiki gaisha Daisōsangyō also written as ダイソー is a large franchise of 100-yen shops founded in JapanThe headquarters are in Higashihiroshima Hiroshima Prefecture. The 3 categories are.

GST compensation cess can apply to the tax payable or paid under the RCM. Rs 25 Total late fees to be paid per day. Goods and Service Tax GST is a destination based tax on consumption of goods and services.

Input Tax Credit ITC Under RCM. Name of the Act Late fees for every day of delay. Goods and services tax GST calculator online.

Western Digital has the best Mac and PC compatible digital storage solutions plus FREE shipping friendly customer support and a 30 day return policy. This Page is BLOCKED as it is using Iframes. The cutoff date for uploading ticket details.

Were taking you to our old site where the page you asked for still lives. Amendments to Bursa Malaysia Securities Berhad Main Market Listing Requirements and Fees and Charges for the Main Market Consequential to the Repeal of the Goods and Services Tax Pursuant to the Goods and Services Tax Repeal Act 2018. The Government will delay the planned Goods and Services Tax GST hike to 2023 and stagger the increase in two steps Finance Minister Lawrence Wong said in his Budget speech on Friday.

Customers are the ultimate bearer of the taxes and there is no cascading of tax as tax payable at each stage is available. The GST details required for invoicing like GSTN name of the user address email id and phone number are captured from either SSR or as per registration on portal. GST - Know about Goods and Services Tax in India with various types and benefits.

COVID-19 support available for business in Australia. Check GST rates registration returns. The recipient can avail of ITC on GST amount paid under RCM on receipt of goods or services only if such goods or services are used or will be used for business purposes.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. GST is levied at all stages right from manufacturer up to the retailer who sells the goods for final consumption. Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017.

A supplier cannot take the GST paid under the RCM as ITC. Consequential to the Repeal of the Goods and Services Tax GST Pursuant to the Goods and Services Tax Repeal Act 2018. The GST-inclusive amount and a statement that GST is included if GST is charged at the standard rate for all the goods or services listed.

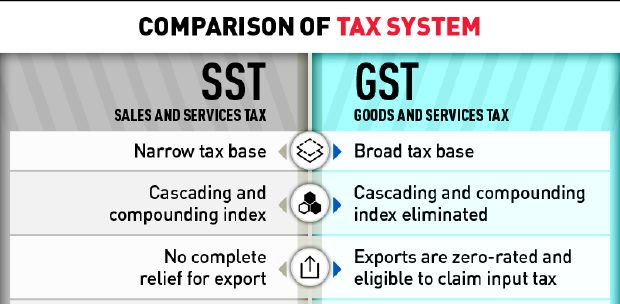

VAT calculator GST tax calculation. The GST-exclusive amount the GST amount and the GST-inclusive amount. Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015.

Late fees for annual GST returns. We have come a long way since our founding in 1972 evolving from a regional airline to one of the most respected travel brands around the worldWe fly one of the youngest aircraft fleets in the world to destinations spanning a network across five continents with the famed Singapore Girl as our internationally-recognisable icon providing the high standards of care and service that. It can be used as reverse GST calculator too.

Daiso Industries Co Ltd. You should always refer to these Rules together with any subsequent amendments issued from time to time. John can also claim an amount that reflects the decline in value of the photocopier on his tax return.

Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check For GST Registered Company By Company Registration Company name or GST Number Senarai Barangan Bercukai Tidak Bercukai List of Taxable Non-taxable Items. The empty string is the special case where the sequence has length zero so there are no symbols in the string. In case details are available against a particular ticket in SSR and also in portal portal data will take precedence for invoicing.

GST tax is charged to the end consumer therefore GST normally does not become a cost to the company. Sales tax was reinstated on 1 September 2018 as Malaysia moved away from the former GST regime. Daiso has a range of over 100000 products of which over 40 percent are imported goods many of them from China South Korea and Japan.

Check GST rates registration returns certification and latest news on GST. Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. John can claim a GST credit of 100 on his activity statement.

More 126. The implementation of GST system that has two rates of GST 6 and 0 and provides for the zero-rating of exported goods international services basic food items and many booksAs a broad based tax GST is a consumption tax applied at each stage. Central Goods and Services Act 2017.

Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia. GST amount GST Rate Net amount. More 125 10052019 Compliance Audit Framework.

Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally. Full Text of the Main LR GST Amendments Effective.

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst In Malaysia Taman Sri Nibong Ra Log

Gst Vs Sst In Malaysia Mypf My

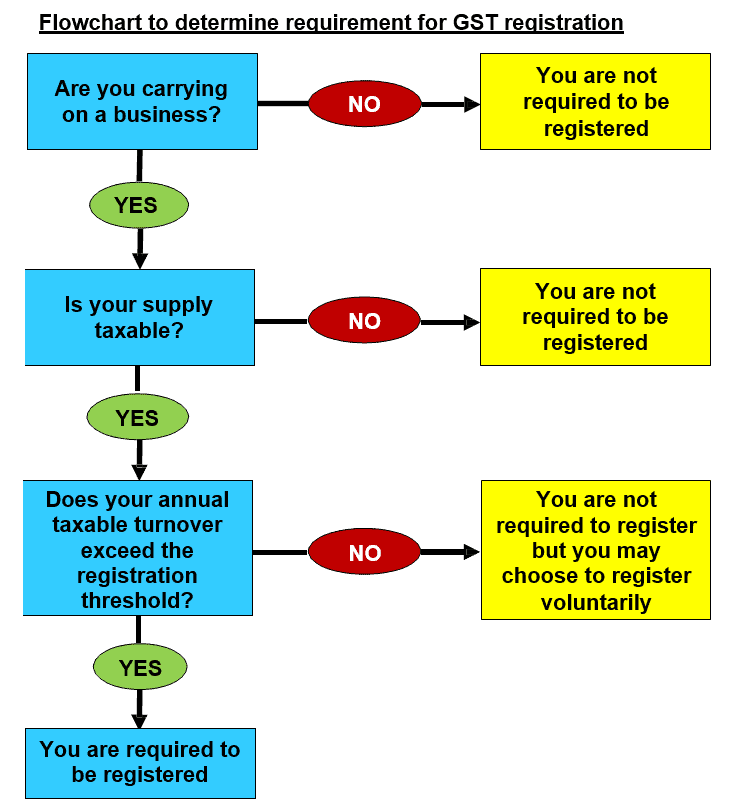

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Revenue Change Due To Transition From Gst To Sst Download Scientific Diagram

Gst Better Than Sst Say Experts

A Guide To Gst In Malaysia How Does It Affect Me

Gst To Be Set To 0 On June 1 No Sst Until Later On What Are The Implications For Malaysian Car Prices Paultan Org

Budget 2022 Malaysia Needs Gst To Weather Turbulence Ahead Say Experts Edgeprop My

Gst Treatment Disbursement Kyrios Resources Facebook

Gst In Malaysia To Be Zero Rated Starting From 1 June 2018 Lowyat Net

An Introduction To Malaysian Gst Asean Business News

0 Response to "what is gst in malaysia"

Post a Comment